If you’re shopping for auto insurance, Geico is probably on your radar, and for good reason. It’s one of the largest and most recognized insurance providers in the U.S., famous for its low rates and that memorable gecko mascot.

But is it actually any good?

How does it compare to competitors like State Farm and Progressive?

And what do real customers say after using Geico?

In this guide, we break down everything, from verified Geico reviews and ratings to pros, cons, comparisons, and claims experience, to help you decide if Geico is the right fit.

🚗 What Is Geico?

GEICO (Government Employees Insurance Company) is one of the largest and most well-known insurance providers in the United States. Founded in 1936, GEICO now serves over 28 million vehicles and is owned by Berkshire Hathaway, Warren Buffett’s holding company.

While most people know GEICO for its famous green gecko and funny commercials, the company is trusted for more than just its advertising. GEICO offers reliable, affordable insurance coverage for cars, homes, renters, motorcycles, boats, and more.

Geico (Government Employees Insurance Company) insurance company offering:

- Auto insurance (their main product)

- Motorcycle, RV, and ATV insurance

- Homeowners and renters insurance

- Umbrella coverage

- Roadside assistance

- Commercial auto policies

Geico is backed by Berkshire Hathaway, which means they’re financially strong and stable — a big plus when trust matters.

Why GEICO is One of America’s Top Insurance Providers

GEICO is often ranked as one of the top three auto insurance companies in the U.S. Here’s why:

- 🚗 Competitive Pricing: GEICO often beats competitors on auto insurance quotes.

- 📱 Tech-Friendly: Their mobile app is one of the best-rated in the insurance industry.

- 🧾 Transparent Process: Simple online quoting, easy claim filing, and 24/7 customer service.

- 🌎 Nationwide Coverage: Available in all 50 states.

- 🧠 Strong Financial Backing: Owned by Berkshire Hathaway.

💬 “I’ve been with GEICO for over 6 years. Their customer service is solid, and I love managing everything from the app.” – Verified Policyholder

GEICO Insurance Products and Services

GEICO offers a wide range of insurance options, making it a one-stop shop for many customers:

Main Insurance Products:

- Auto Insurance

- Motorcycle Insurance

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Boat & Watercraft Insurance

- RV Insurance

- Commercial Auto Insurance

- Mexico Auto Insurance

- Pet Insurance (partnered with Embrace)

- Travel Insurance (partnered provider)

- Umbrella Insurance (for extra liability)

Tip: You can bundle several GEICO insurance types for discounts and convenience.

GEICO Car Insurance: What You Need to Know

Car insurance is GEICO’s flagship product, and they offer full coverage options, including:

- ✅ Liability Coverage

- ✅ Collision and Comprehensive

- ✅ Personal Injury Protection (PIP)

- ✅ Uninsured Motorist Coverage

- ✅ Mechanical Breakdown Insurance (MBI)

- ✅ Roadside Assistance

- ✅ Rideshare Coverage (Uber/Lyft)

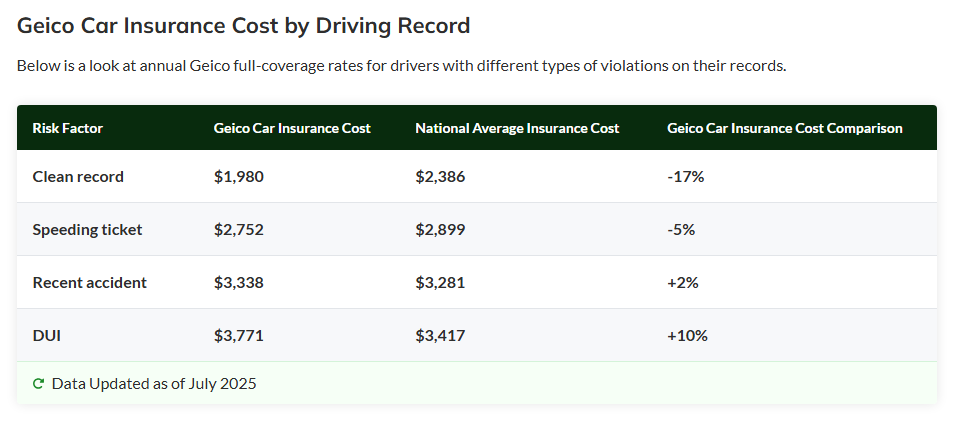

How Much Does GEICO Car Insurance Cost?

Average costs vary by state, but GEICO is known for being 15% cheaper than many other major providers.

| Driver Type | Avg. Monthly Premium |

| Good Driver (30 yrs) | $90 – $110 |

| New Driver (22 yrs) | $150 – $180 |

| With Accident | $160 – $200 |

You can get a personalized quote online in under 5 minutes.

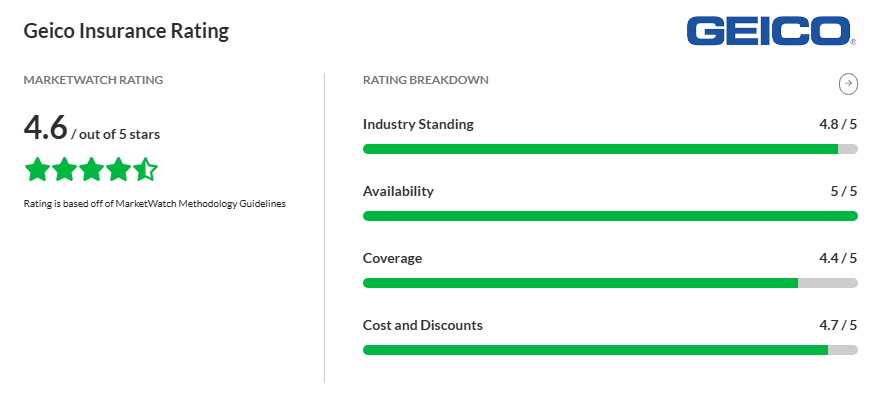

Geico Reviews & Ratings (Backed by Trusted Sources)

⭐ Geico – Overall Customer Rating

Overall Rating: ★★☆☆☆ (2.5/5.0) Based on 2,200 verified reviews. Read more real reviews on Yelp, Consumer Affairs, & MarketWatch Guides.

According to NerdWallet’s 2025 Review, Geico earned a 4.2 out of 5 stars overall, based on affordability, digital experience, and customer support.

From the J.D. Power 2025 U.S. Auto Claims Satisfaction Study, Geico scored 871 out of 1,000, which is above the industry average and puts it ahead of Progressive and Allstate in many regions.

Trustpilot Score:

⭐ 3.8/5 stars based on 4,800+ reviews

At-a-Glance: Geico Review Summary

| Category | Rating | Details |

| Customer Satisfaction | ★★★★☆ (4.2) | Strong for pricing and digital convenience |

| Claims Handling | ★★★☆☆ (3.5) | Varies by location and case complexity |

| Customer Support | ★★★★☆ (4.1) | 24/7 support, app chat, responsive agents |

| Mobile App Experience | ★★★★★ (5.0) | Highly rated and user-friendly |

| Pricing & Discounts | ★★★★☆ (4.3) | Excellent for students, military, and safe drivers |

Pros and Cons of Geico (2025 Edition)

✅ Pros:

- Affordable premiums, especially for safe drivers

- Award-winning mobile app and website

- Strong digital claims tools (including photo-based estimates)

- Lots of discount options (multi-policy, good student, military, etc.)

- Financially stable with fast quote generation

❌ Cons:

- Not ideal for high-risk drivers (rates may spike)

- Limited in-person agents (compared to State Farm)

- Mixed feedback on claim response times

💬 What Real Customers Say About Geico

From Trustpilot, Reddit, and Online Forums:

🗣️ “I used the Geico app after my fender bender and submitted photos right from my driveway. Their photo estimate tool gave me a quote in under 30 minutes, and I had a repair appointment booked the same week.”

— Verified user via Reddit AutoInsurance thread

🗣️ “They handled my windshield replacement super fast. I called in the morning, and Safelite was at my house by noon.”

— NerdWallet user review

🗣️ “Filing the claim was easy online, but it took 2 weeks to get someone to finalize the reimbursement. Still, they covered everything.”

— Trustpilot reviewer, June 2024

These real-world reviews show that Geico’s digital systems are a win, but there can be delays depending on the complexity of the issue.

Geico’s Digital Experience: A Major Strength

Geico leads the pack in user-friendly digital tools:

App Features:

- Digital ID cards

- 24/7 claim filing

- Roadside assistance request

- In-app bill pay and coverage changes

- Real-time claim tracking

It’s consistently rated 5 stars on both iOS and Android, and even includes virtual assistant support.

💡 Many customers say they haven’t needed to call customer service in over a year — everything is handled in-app.

GEICO Discounts: How to Save More on Insurance

GEICO offers a variety of policy discounts based on your lifestyle, driving habits, and vehicle features.

Popular GEICO Discounts:

- ✅ Good Driver Discount

- ✅ Multi-Policy Discount (bundling)

- ✅ Good Student Discount

- ✅ Military Discount

- ✅ Federal Employee Discount

- ✅ Multi-Vehicle Discount

- ✅ Anti-theft Device Discount

- ✅ Safe Vehicle Discount

- ✅ Low Mileage Discount

You could save up to 25% by stacking multiple discounts.

How GEICO Handles Claims: Process and Support

GEICO has an easy-to-follow claims process backed by strong customer service.

Claims Process:

- Report online, by phone, or via app

- Upload photos and documents

- Get a damage estimate

- Schedule repairs or receive payment

GEICO works with GEICO Auto Repair Xpress® shops for faster repairs.

Claims support is available 24/7 at geico.com/claims.

Geico vs State Farm vs Progressive: Quote Comparison

Here’s how Geico stacks up against its main competitors:

| Feature | Geico | State Farm | Progressive |

| Avg. Monthly Cost | $110–$140 | $120–$150 | $125–$160 |

| Best For | Low-risk drivers & tech-savvy users | Local agent support | High customization |

| Claims Satisfaction (JD Power) | 871/1000 | 882/1000 | 861/1000 |

| Mobile App Rating | ★★★★★ | ★★★★☆ | ★★★★☆ |

| Policy Flexibility | High | Moderate | High |

| Local Agents | Limited | Extensive | Moderate |

Verdict:

Choose Geico if you want digital ease and lower premiums.

Choose State Farm if local support is your top priority.

Choose Progressive for unique driver situations or usage-based plans.

Is Geico Cheap or Expensive?

Geico is one of the most affordable insurance options, especially for:

- Drivers with clean records

- College students

- Military families

- Multi-car households

But prices can rise if you:

- Have recent accidents or tickets

- Are you a very young or very old driver

- Require high-risk coverage

Always compare quotes, because Geico is not always the cheapest in every ZIP code.

How Does Geico Handle Claims?

Most claims can be filed in under 10 minutes via the app or website. Customers love the photo estimate tool, which saves time and trips.

Pros:

- Easy to file and track claims online

- Quick photo estimates

- Direct repair shop partnerships

Cons:

- Some users report delays in complex claims

- Communication may vary by adjuster

🗣️ “After a minor accident, I uploaded pictures through the app. Got an estimate the same day and repairs were approved fast.”

— Reddit reviewer, r/Insurance

Frequently Asked Questions

❓ Is Geico a good insurance company?

Yes — Geico is highly rated for affordable premiums, strong tech, and customer satisfaction. It’s especially great for those who prefer managing their policy online.

❓ Why is Geico so cheap?

Geico operates primarily online and over the phone, which lowers administrative costs. They also offer smart discounts for bundling, safe driving, good grades, and military service.

❓ Does Geico raise rates after an accident?

Yes, in most cases, your rate may go up if you’re found at fault. However, Geico offers accident forgiveness for eligible drivers, which may prevent a rate hike after your first accident.

❓ Can I cancel Geico easily?

Yes — cancellation is free and can be done by phone or mail. Geico even prorates your unused premium and returns the balance.

❓ How do Geico’s discounts compare to other insurers?

Geico offers more than 16 discount types, which is more than most competitors. These include:

- Multi-policy

- Defensive driving

- Good student

- Vehicle safety features

- Federal employee or military

Final Verdict: Is Geico Right for You?

✅ Choose Geico if you:

- Want affordable, no-frills insurance

- Prefer to manage everything via app or website

- Qualify for discounts (student, military, good driver)

- Value quick online quotes and smooth policy setup

❌ Skip Geico if you:

- Prefer a local agent you can visit

- Have a complicated or high-risk driving history

- Want ultra-personalized claim support

Bottom Line:

Geico continues to be a top choice for digital-first drivers and those looking to save. It may not be perfect for everyone, but for the majority of U.S. drivers, it offers a strong blend of value, tech, and trust.

Please also read articles about the following: